Did you know that most international money transfers incur hidden fees that can inflate your costs by over 10%? Even the savviest consumers are blindsided. But there's a method to reduce these expenses significantly.

With families and businesses more global than ever, finding the most cost-effective way to send money home is paramount. This isn't just about saving a few bucks—it's about maximizing the value of every transaction.

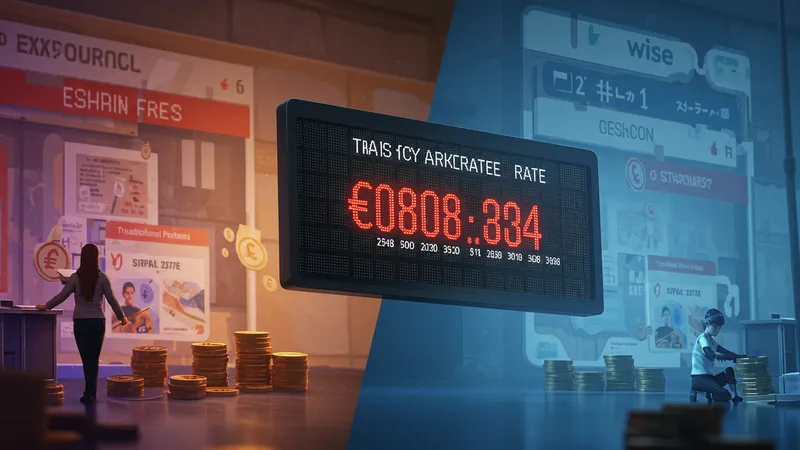

Here's something that might shock you: banks often hide exchange rate markups within their fee structures, costing you more than you realize. This markup can secretly turn a seemingly low-cost transfer into an expensive one. But that’s not even the wildest part…

Some digital platforms claim "zero fees" but compensate by offering unfair exchange rates. You might think you're getting a bargain, but in reality, they're gaining a profit margin on your transactions. What happens next shocked even the experts…

When sending money across borders, the fees can quickly accumulate. Banks usually charge not only a flat fee but also inflate the exchange rate, subtly increasing your costs. This dual-cost structure means that the recipient gets less for the same amount of money sent. But there’s one more twist…

Many people assume that using well-known banks for transfers ensures reliability and security. While this is generally true, it often comes at a higher price. These banks leverage their reputation to justify hidden fees that most customers remain unaware of. Discovering the true cost can be an eye-opener.

Digital platforms have found a niche by offering more transparency in fees. Yet, the real exchange rate is not always applied unless specified by the user. This detail is crucial and often missed by those who assume all digital services are automatically fairer than traditional banks.

But even in the digital world, currency conversion plays a stealthy role in upscaling expenses, especially with unsupported currencies. The available rate can be far from the market rate, but there’s a technique to navigate this… What you read next might change how you see this forever.

The mid-market rate, often referred to as the "real" exchange rate, is the rate that banks use when trading among themselves, but it’s rarely offered to individual customers. Most financial institutions apply an additional margin. This difference can sometimes mean the recipient gets significantly less money.

Platforms like Wise have brought transparency by using the mid-market rate, earning profits only through nominal transfer fees. This practice challenges the status quo, prompting other services to follow suit. Understanding this could mean thousands more in savings per year for frequent senders.

Customers often feel comfortable with solutions providing simplicity, yet simplicity doesn’t always translate to savings. Investigating what your provider really offers can lead to choosing better methods. Those who do unlock astonishing savings, but not everyone recognizes the clues easily.

The secret? Asking the right questions and checking all accessible options before committing funds to a transaction. Can you imagine saving hundreds with just a few clicks? A slight change in approach can revolutionize your international financial strategy.

Most people stick with traditional methods because they appear straightforward. However, these methods are often the most costly. Online platforms today offer lower fees and better exchange rates, as users bypass several bank processes. But is it enough to just switch providers?

Switching not only boosts savings but also speeds up transactions. Many new platforms enable transfers within minutes, which is crucial during emergencies. The convenience here is unmatched but is easily overlooked by those who haven’t explored beyond their habitual providers.

The uncertainty lies in security concerns. However, many digital platforms match traditional banks in terms of safety, thanks to strict regulations. What was once the privilege of a few, secure transactions are now available to all with minimal risk, yet there’s an underestimated risk…

Transitioning to digital platforms also offers insights into spending habits and provides more control over transactions. These insights can fuel smart decisions and enhance financial well-being. But what remains puzzling is how these platforms will evolve next.

The realm of international money transfers is on the brink of a digital revolution. Innovative technology is predicted to further reduce costs and simplify processes, benefiting users. The movement towards more sophisticated, real-time tracking of money transfers is already underway.

Blockchain technology, while still in its infancy in this sector, shows promise in eliminating intermediary costs and enhancing security. As transparency increases, customers will likely gain more bargaining power. But the full implications of these advancements are yet to be fully realized.

Cryptocurrency-based solutions are also entering this field. These solutions offer near-instant transactions and significantly reduced fees. Despite the volatility of cryptocurrencies, some are beginning to accept it as a viable alternative for certain types of transfers. How these will integrate with current systems remains an intriguing question.

The most critical change may not be in technology but in consumer awareness. More informed customers pressing for transparency and fair deals could accelerate the adoption of these innovations. How quickly this shift happens could redefine the playing field for money transfers.

Understanding industry jargon can be pivotal in uncovering the best deals. Terms like “spread,” “mid-market rate,” and “remittance” can significantly impact your money’s value. Knowing these can turn a cumbersome transaction into a savvy investment.

The term “spread” refers to the difference between the buy and sell rate offered to customers. This hidden cost adds up over multiple transactions. But, with increased competition, some platforms now lower spreads to attract customers. Knowing the spread helps dissect real costs.

Mid-market rates reflect the true value of currencies without additional costs. Platforms promoting transparent practices use these rates, empowering customers to make informed decisions. The significance is evident when contrast emerges with banks’ application of less favorable rates.

Remittances, a crucial financial lifeline for millions worldwide, often get buried under complex fee structures. But understanding the nuances of these transactions can elevate the decision-making process, resulting in substantial savings. What happens when you decipher these terms can be truly enlightening.

While many costs associated with money transfers can be circumvented, some fees appear unavoidable. Transaction processing costs ensure that sent money reaches its destination. However, transparency here can still significantly vary among providers.

Currency conversion often traps users into higher fees through mechanisms that make recipients bear the brunt of inflated rates. In contrast, the sender is shielded, creating a seemingly frictionless perception. But seeing through this illusion can lead to more judicious selections.

Another unavoidable cost is tied to dynamic currency exchange (DCC) during transactions, which while offering convenience, involves variable exchange rates that can be unfavorable. Recognizing this ahead can lower unexpected charges.

Bank account maintenance fees also play into how the sender and recipient interact with their accounts. When these fees are understood, they can be minimized by choosing the right types of accounts and transaction methods. This nuanced understanding can yield huge advantages.

While seemingly convenient, quick transfer solutions can entail hidden costs. These often include service fees disguised within user-friendly interfaces. The desire for swift transactions can overshadow cost awareness entirely.

Convenience often means fewer checks, leading to less scrutiny over details like exact exchange rates. Yet, those who pay attention to these specifics can reveal significant savings. It’s alarming how easily immense costs are hidden behind seamless operations.

Additional costs surface when digital platforms charge premiums for accelerated services. The question emerges: is speed worth the extra expense? Evaluating necessity over urgency can unravel substantial financial insights.

Ultimately, the challenge lies in balancing convenience with transparency. Consumers who dig deeper see the value in opting for more transparent services, redefining their transfer strategies. As awareness increases, the emphasis on convenience might shift unexpectedly.

Want to save big? Always compare the total cost of transfer including the exchange rate margin and service fee before executing any transaction. Providers offering real exchange rates are often more economical.

Engaging multiple platforms can sometimes offer surprising advantages, such as first-time user discounts or country-specific deals, effectively lowering costs. Monitoring these opportunities can lead to unexpected benefits.

Referral programs are another tailored strategy to minimize costs. Platforms reward users with reduced fees or credits for recommending their services to others. This kind of community-driven value can compound significantly over time.

Timing transfers during favorable currency market conditions can also have a notable impact. Fluctuations in exchange rates mean transactions become cheaper as these currencies strengthen. Choosing the right moment could revolutionize your sending strategy entirely.

Exchange rates, often neglected during transactions, play a pivotal role in determining the recipient’s final amount. A seemingly small difference can translate to large discrepancies in value.

Lower fees might initially attract you to a service, but a poor exchange rate can easily nullify those savings. It’s crucial to understand the interplay between fees and rates fully for a broader perspective.

Forward contracts are tools that can help lock in current exchange rates for future transfers, providing an edge in a volatile currency landscape. This smart move ensures that today’s rates are preserved for future use, protecting interests.

Being aware of trends enables better decisions on when to transfer funds. As currencies fluctuate, capitalizing on these developments can secure improved terms—changing the way you perceive exchange rates forever.

Ethical considerations are emerging as a priority in the money transfer sector. Customers now value transparent businesses that not only offer fairness in rates but also engage in responsible practices.

The rise of platforms that fund charitable causes with every transaction mirrors changing consumer priorities. By selecting such services, users actively contribute to ethical causes while fulfilling their financial needs.

However, consumers must dig deeper to authenticate these claims. The real challenge lies in distinguishing between marketing tactics and genuine commitments to ethical business operations. Understanding these nuances can redefine consumer choice.

Commitment to responsible behavior is not just an optional attribute but increasingly a defining factor for many. The sector’s future might be more linked to its present ethical shifts than previously observed, promising intriguing developments ahead.

Traditional banks find it hard to compete with nimble digital platforms. The biggest hurdle remains their rigid infrastructure, making rapid adaptability a struggle despite growing pressures.

Regulatory constraints and bureaucracy complicate their attempts to modernize and match competitors. This difficulty in reform is evident in the persistent use of legacy systems that delay process improvements compared to agile counterparts.

Conversely, customer trust remains an advantage due to years of dependable service. However, as younger, tech-savvy demographics increasingly prioritize cost over legacy, banks could face increasing client churn without innovation.

Understanding these dynamics highlights the need for traditional banks to evolve or risk erosion of their established bases. The pivotal question: Can long-standing institutions transform rapidly enough to maintain their relevance?

Fintech innovation is transforming the money transfer landscape. Emerging companies offer cheaper, faster, and more accessible alternatives, challenging traditional systems with sophisticated technology redesigns.

This disruption begins with peer-to-peer platforms that connect users directly, reducing middlemen costs and refining fee structures. The streamlined approach is increasingly favored for its satisfaction to user expectations.

Combined with AI and blockchain, these platforms promise enhanced speed and security, dismantling preconceived transaction barriers. The resonance of these advancements cannot be understated—especially amidst increased global interconnectivity.

However, as fintech popularity grows, questions around privacy and data protection surface. Consumers and regulators must navigate these complex concerns, shaping the future of global remittance services significantly.

Timing can influence the financial benefit of transactions dramatically. Currency fluctuations can significantly impact the value received by the beneficiary, altering landscapes overnight.

Monitoring exchange rates and recognizing the strategic timing for transfers is akin to stock market trading. Those who master this aspect often unlock ongoing savings with minimal investment effort.

The art of predictive analysis, supported by innovative applications, allows those transferring money regularly to anticipate peaks and troughs in currency values, gaining competitive advantages.

Understanding global events and economic indicators adds another layer of insight, helpfully augmenting one’s strategizing capability. Navigating this framework can ensure optimal transfer outcomes, akin to securing fiscal success on a grand stage.

The hidden world of international money transfers reveals critical insights that could change your financial future. Recognizing the interplay between fees and exchange rates, timing strategies, and the ethical dimensions of service choice, you are better positioned to make informed decisions. Share this article with someone who needs to unlock the true potential of their money transfer capabilities and watch the benefits unfold!